Friday, October 28, 2016

Podcast: Meea Kang on Developing Affordable Housing in California

Wednesday, January 28, 2015

How Should The Government Fix Affordable Housing?

Housing costs in San Francisco have skyrocketed in the past few years and it doesn’t look like they’ll stop increasing any time soon. One of the reasons for the price increase is because discretionary permitting prevents the housing supply from increasing rapidly as the population grows. Some such as the blog Market Urbanism believe that reforming regulations so that development is less restricted would go a long way in addressing the issue. On top of that, creating a land tax would encourage denser development, and funding housing vouchers with that tax money would ensure that the amount of funding increases when housing demand goes up and drives up the cost of land.

Los Angeles is suffering from a lack of affordable housing as well, and some feel that the local government should be doing far more to address the issue. Some suggested solutions to LA’s affordable housing issue include overhauling the zoning code so that it’s easier to develop, offering incentives to developers for building affordable housing, and preserving the current stock of affordable housing.

All of these proposed solutions include some form of government intervention. However, we have seen that some government responses, like rent control and subsidized housing, have not exactly solved the affordable housing problem in the past. If that’s the case, how should the government intervene in affordable housing issues? Whichever way we choose to address the problem, it’ll be important to understand the housing market, as well as acknowledge the shortcomings of our previous solutions.

Thursday, May 13, 2010

On Gentrification, Supply, and Expansion

I sometimes wonder why we can't just build more dense housing in employment districts or places where NIMBYs don't exist. There's a huge supply of land in these areas of San Jose with parking lots that could use serious transit infrastructure expansion. But the fact of the matter is that areas that are really desirable and dense are for the most part built out, and since they are built out their cost continues to increase dramatically because people really want to live there and there is a limited supply.

Take for example the Mission in San Francisco. For many years it was a lower income neighborhood known for its culture but over time transitioned. There are still vestiges of this in the compact and livable urban environment, but now the hipsters have come. I'm not sure that's a bad thing per say but we've seen this story before. Certain parties populate an urban neighborhood and then others follow until it becomes upper class, it gentrifies/yuppifies (a good read here on this subject). This end state of neighborhoods is seen as awful for the folks that were pushed out, but it is also seen as progress for the city as buildings get painted and the garden flowers are potted. This very end state of the process or "Starbucks Urbanism" is what becomes the mark of progress for those seeking it.

The problem however I see with this is not the end state per say, but the fact that the process has to happen at all. The biggest issue I have with the gentrification claim is that it can be rendered useless if we actually supplied housing for the actual market for housing. I know this is a claim long pushed by the planners and CNU set, but there's actually something behind the idea that we've overproduced single family housing and under produced urban types. What we've seen in urban neighborhoods with good bones over the last decade or so is a transformation based on lack of opportunity to improve without pushing out the middle.

But I do see a possible opportunity in the massive expansion plans that exist due to the transit space race to improve without pushing away. With multi-line expansion plans in places like Los Angeles, Denver, and Seattle, so many stations will be brought on line, the market won't be able to get to them all at once. One of the major benefits and worries of these new transit lines is that they will bring increased property values and push out existing communities. While this will provide better mobility to many of these areas, it's not likely to bring wholesale change to each of them. But it does start to provide opportunities for building housing that starts to change the urban vs. suburban market, without focusing it all on one close in neighborhood such as what has been happening in smaller regions that build transit over the last boom. We'll see what happens, but this is the theory I have.

Tuesday, November 24, 2009

Monday Night Notes

~~~

Can you reduce GHGs and still grow?

~~~

Is Paris more accessible than London? Some physicists say yes because the ants told them. Via Price Tags

~~~

Can space be found for affordable housing in New York City?

~~~

An interesting thought, the city as a living machine. How can we bring cities back to a pre-city natural state while still growing? This is an idea that is being explored in many places. A variant on this was discussed last year when discussing plans for the Lloyd district in Portland. It opened up some interesting discussion in the comments.

Tuesday, April 28, 2009

A Hearty Congratulations

Monday, April 27, 2009

One Car, Two Car, Three Car, Blue Car

Friday, February 27, 2009

Preserving Affordable Housing Near Transit

This is only eight cities with rail transit but when you think about the mobility that transit allows for people who already have a hard time, it's an even bigger deal when it disappears. A recent Center for Housing Policy report found that low and moderate income families spend as much or more on transportation than they spend on housing. So you can see why it would be important to preserve housing such as this near transit stations in order to give folks more opportunities than they would have if they lived on the periphery. There should be a concerted effort to preserve these affordable units near transit.

So imagine my hope rising when the MacAurthur Foundation along with Enterprise Community Partners pledged $3.5 million dollars to fund new and preserve affordable housing units in the Denver region near transit corridors.

ULC — a nonprofit group affiliated with the Denver Foundation that buys, preserves and develops urban real estate — is expected to be the sole borrower of the fund, and will be responsible for buying property for the TOD housing and partnering with local companies for site redevelopment.

For the TOD housing project, the ULC will target three types of properties — existing, federally assisted rental housing; unsubsidized rental properties; and properties that currently are vacant or used for commercial purposes that have desirable locations for new affordable housing.

This is a way to get out in front of the market. If used intelligently, much of the money could be used for landbanking along future transit corridors then provided to affordable housing developers who could never get in on the market later on. I hope this is replicated in other cities soon.

Thursday, November 13, 2008

Insurance By the Mile

Monday, October 13, 2008

Living in Exurbia Getting Expensive

Thursday, October 2, 2008

The Queen Turned King

As Ryan has said, Charlotte looks like it won't get hit too hard by sudden bank death syndrome but the Urbanophile's comments got me to thinking. While Charlotte is out there scaring the pants off of not only the Rust Belt, but titans of the South like Tampa and Atlanta, is it really because they "want it more"? When I ran back in college, I would like to say that if I ran against Haile Gebresellasie in the Marathon (He broke the world record this weekend) I could win if I wanted it more, but we know that's not even close to being true.

But what are Charlotte's advantages? I thought really hard and tried to think about it in terms outside of the creative class argument that people always try to make about cool places. I kept thinking about things like new beginnings and not really having glory days to look back on but when it got down to it the thing that stuck out to me was age group. Why are cities like Charlotte places where younger folks want to locate. I'll admit when I got out of grad school it was Denver, San Francisco, or Austin. But there has to be more than that right? I must not be thinking hard enough.

Everything I seem to come up with is without a backup in data, such as its a younger city in terms of infrastructure. But that doesn't explain cities like San Francisco or Chicago. Is it because banking was thriving and growing and folks moving down from the Northeast wanted to make it more familiar? Maybe that is it. All of these new exciting cities seem to have an influx of people from either California or the Northeast. It's certainly not Nascar thats pulling them towards Charlotte. I still can't bring myself to think that it's because cities don't want it bad enough. Thoughts?

Sunday, September 28, 2008

It's Like Getting a Raise

But the highway mentality and misunderstanding of investments for people versus cars are still out there.Jeanne Whitworth, wearing a dark blue jacket and skirt, settles into a Sprinter car at the Oceanside Transit Center, awaiting the four-stop ride to Rancho del Oro, where she lives. Whitworth, who works in downtown San Diego, commutes weekdays on both the Sprinter and the Coaster, a conventional Amtrak-style train, which intersect at Oceanside.

The two trains take an hour and a half. Whitworth, 42, could be home 15 minutes earlier if she drove there from Oceanside. "But I don't have to fight the traffic," she says, and she's saving a tank of gas every month. "It's like getting a raise."

Cooke, a retired Marine Corps major-general, contends that $500 million would have been better spent adding two more lanes to six-lane Highway 78. He's also critical of the train's taxpayer subsidy, saying that everyone riding the Sprinter "is getting a free ticket to some degree."

Wednesday, July 16, 2008

Where You Live, and What It Costs

Wednesday, June 4, 2008

It's All About the Benjamins

That's the good kind of wealth transfer. Back into your pocket. So if all those folks filling up the lot at I-485 at the South End of the line saved $75 a month. That is $900 a year. No chump change for sure. It comes out to $672,000 a year in people's pockets. Or $20 million over the 30 year life of the vehicles. And that's just one station. Think about the folks who get rid of cars in the South End or Uptown Charlotte. Big money...for real people.We talked with several riders who say gas prices and convenience have prompted them to give light rail a try, opting to pay $2.60 for a round trip ticket, rather than a gas guzzling trip to work.

“I did an analysis of it and I save $150 a month, not have to pay to park and drive my SUV uptown,” said Tim Gray, who has been riding light rail since its launch in November.

“I think I'm saving $75 to $100 a month. It really adds up,” said Bernice Parenti, who started riding a month ago.

Thursday, April 10, 2008

The Affordability Index is Online

Take a look at the costs of different neighborhoods. In a transit rich neighborhood with all housing being equal, your cost of would be 41%. But if you had to drive everywhere, your costs would be 57%. That's quite a lot of savings by living near transit. See for yourself if you live in a transit rich or auto dependent neighborhood.

H/T Carless in Seattle.

H/T Carless in Seattle.

Thursday, February 21, 2008

Is Auto Ownership Tied to a Reduced Savings Rate?

While everyone thinks that America is a wealthy nation, many people spend a good portion of their money on transportation. But it doesn't have to be this way. Cities that have good transit networks allow people to save money and cut overall emissions.

While everyone thinks that America is a wealthy nation, many people spend a good portion of their money on transportation. But it doesn't have to be this way. Cities that have good transit networks allow people to save money and cut overall emissions. I want to reiterate that I think cars are an important part of our transportation network, but I think our complete dependence on them in most of the United States will lead many to the poorhouse sooner rather than later. In order to stem the tide, we need good transit. It allows people to pool their resources to pay for transport and allow for the building of wealth.

Saturday, January 5, 2008

Giving Employees a Bonus by Charging for Parking

Thursday, November 15, 2007

So What Pencils?

So when cities come up with extensive plans for the area around a light rail station that won't be there for a few years, what is a developer or city to do? The City of Aurora south of Denver is in that predicament right now. So what are citizens who want good development to do?

One way to go is to bank the land and do something that can be easily be turned when the market changes or when the rail line extension comes. Community land trusts and affordable housing funds could possibly do this or the city could buy it to hold although thats almost like the third way below. Another is to let them develop the junk they were going to, which in the case of Aurora, like Austin, is the much hated Wal-Mart. A third and sometimes unpopular way to go is to provide incentives to make the development pencil. This is what Aurora is thinking about as well.

Bob Watkins, Aurora's director of planning, said Aurora hopes the vacant plot will be developed into "a special place that would be unique and help establish an identity for the city."A big problem is figuring out where that is going to be since engineering on LRT projects and other improvements might take years. This is where developers can take issues into their own hands if they decide to help build these transit lines. Perhaps we'll start seeing more of that soon. So when a piece of land is scoped for future development, better make sure that everything people want is in order (coding, zoning, plans, affordable housing, etc) so you don't get unlucky and stuck with Wal-Mart or providing incentives.

The city is currently trying to develop an incentive package for the project.

"It probably is going to require some kind of incentive package ... I think the time is right. We have things happening with FasTracks, with RTD, everything that's going on," Hogan said.

RTD plans to extend light rail from the Nine Mile Station at Parker Road along I-225 and then swing away from the highway with a station planned at the location.

Update: Here is a map of the area. The line will take an angle and go right.

Update 2: Had the wrong line. Better picture below.

Monday, August 6, 2007

When the Bubble Pops

So when the housing market is down, what are the good investments? Apparently in New Jersey its housing near commuter rail stations. Easy access to transit and less housing cost is where people are going. According to realtors:

Homes along many of Central Jersey's commuter rail lines have a better chance of being sold than residences in more rural or suburban areas, according to real estate experts and housing statistics.

That's one of the conclusions drawn from a study of the sales numbers, which paint an uneven -- and depending upon where you live, unsettling -- picture of the Central Jersey housing market.

In some towns, the market is actually improving over last year, while in other areas, homes are languishing on the market even longer than in 2006, when the real estate bubble burst in earnest. Prices began to get soft in August 2005.

Hat Tip to Atrios & The Big Picture

Sunday, July 8, 2007

Autocentricity in Consumerism

But what does this say about the overall consumer culture and our debt? Given that the median balance on the American credit card is $1,900, and 43% of Americans spend more than they earn, does this mean we are slaves to our cars?

According to this MSN Money article, the debt of America outside of our Mortgage is largely tied to non-revolving loans like the ones available for people to buy cars. That's just the capital cost for the car. Now what about operating the thing and roads? In 2005, the average American spends 18% of their income on transportation. Recent research suggests that this fluctuates between the exurbs and transit rich urban core with a difference of up to 16% between the extremes of 25% and 9% respectively.

In my own experience, I drive my car once a week and fill up the tank once a month. I probably wouldn't drive at all if my grandmother didn't live so far from BART. Otherwise I take Muni, BART, or walk. I would say that I'm around the 9% in transportation costs which allows me to pay a bit more in rent than I normally would be able to afford. But I'm also able to save up some money.

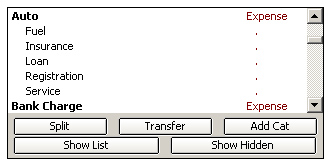

So in a consumer based, auto oriented society, we are largely tied to our cars, figuratively and sometimes literally. Over the last 60 years we've been so tied down that even personal finance software doesn't give us a transit choice but to enter it in ourselves. But as we've found out from parking, when given the choice for someone to unbundle, a lot of people will choose the alternative because there is one to choose. Someone gave an analogy recently, and forgive me for stealing it if you're reading but if there is a shelf full of only Pepsi how can you say that no one wanted to buy Coke? The choice wasn't there.

Friday, January 19, 2007

The Real Reason You're Broke....

Americans are spending more on their vehicles than ever before -- more than $8,000 a year on average -- and it's driving some to the breaking point. Credit counselor Bill Thompson of Jacksonville, Fla., estimates that one out of every four clients his agency sees has overspent -- sometimes dramatically -- on a car. "They may be spending 15% to 20% of their (take-home) pay on just the car payment," said Thompson, who supervises credit counseling for the nonprofit Family Foundations, "and that doesn't include insurance, gas, maintenance and all the other costs of owning a vehicle."Quite Amazing, perhaps transit is a part of the affordability solution. To take a look at how to address this issue through transit, check out the Affordability Index.